us exit tax percentage

Federal income tax rates range from 10 percent to 37 percent. The Basics of Expatriation Tax Planning.

Exit Tax Us After Renouncing Citizenship Americans Overseas

The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as.

. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. For eligible plans US expatriates may be subject to a 30 US tax rate on all taxable payments which is to be deducted and withheld by the payor. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

The term expatriate means 1 any US. Currently net capital gains can be taxed as high as 238 including the net. The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs.

Exit tax applies to United States expatriates a term describing people who have renounced their US citizenship and those who have renounced a Green Card that they have held for at least eight years out of the. Exit taxation also known as an exit fee exit payment compensation payment or exit charge is a payment made for discontinuation of certain economic activities within corporate groups required in many tax jurisdictions by transfer pricing regulations. Relinquishing a Green Card.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

You will also be taxed on all your deferred compensation. In special cases individuals may be exempt from this tax under certain tax treaties. Legal Permanent Residents is complex.

If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you expatriate is US1200 per ounce then you have no unrealized gain and wont owe any Exit Tax. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. Exit Tax and Expatriation involve certain key issues.

The United States has a unified gift and estate tax system that applies to gifts made during life and bequests made at death. Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act. Different rules apply according to.

877Af1AA covered expatriate can opt out of this method and elect not to use the wait-and-seeapproach and to instead accelerate income recognition. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation. If you have any difficulty with this it is a good idea to contact a tax accountant as they can estimate the amount that you would have to pay.

1 737 205 6687. These simplified single-issue examples are only for clarity. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status.

Youre going to get taxed by the IRS on that US1 million gain. Resident status for federal tax purposes. One system of estate and gift taxation applies to US citizens and.

As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. The HEART Act also added the inheritance tax a 40 flat tax on the gross value of a covered gift or covered bequest made to a US. Within the European Union exit taxation is provided for in Article 5 of Directive 20161164 of 12 July 2016 laying down rules.

For 2021 the highest estate and gift tax rate is 40 percent. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly. Tax is imposed when distributions are made to a covered expatriate at which time the trustee of a nongrantor trust must withhold 30 of the taxable portion of the distribution Sec.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Citizens who have renounced their citizenship and long-term residents as defined in IRC 877 e who have ended their US.

If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home.

The Tax Consequences Of Renouncing Us Citizenship

New Homes For Sale In Riverside Jurupa Valley California New Homes In Riverside And Jurupa Valley Canter New Homes For Sale Valley View New Home Builders

What Are The Us Exit Tax Requirements New 2022

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Investing Archives Napkin Finance Investing Personal Finance Budget Finance Investing

Exit Tax In The Us Everything You Need To Know If You Re Moving

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

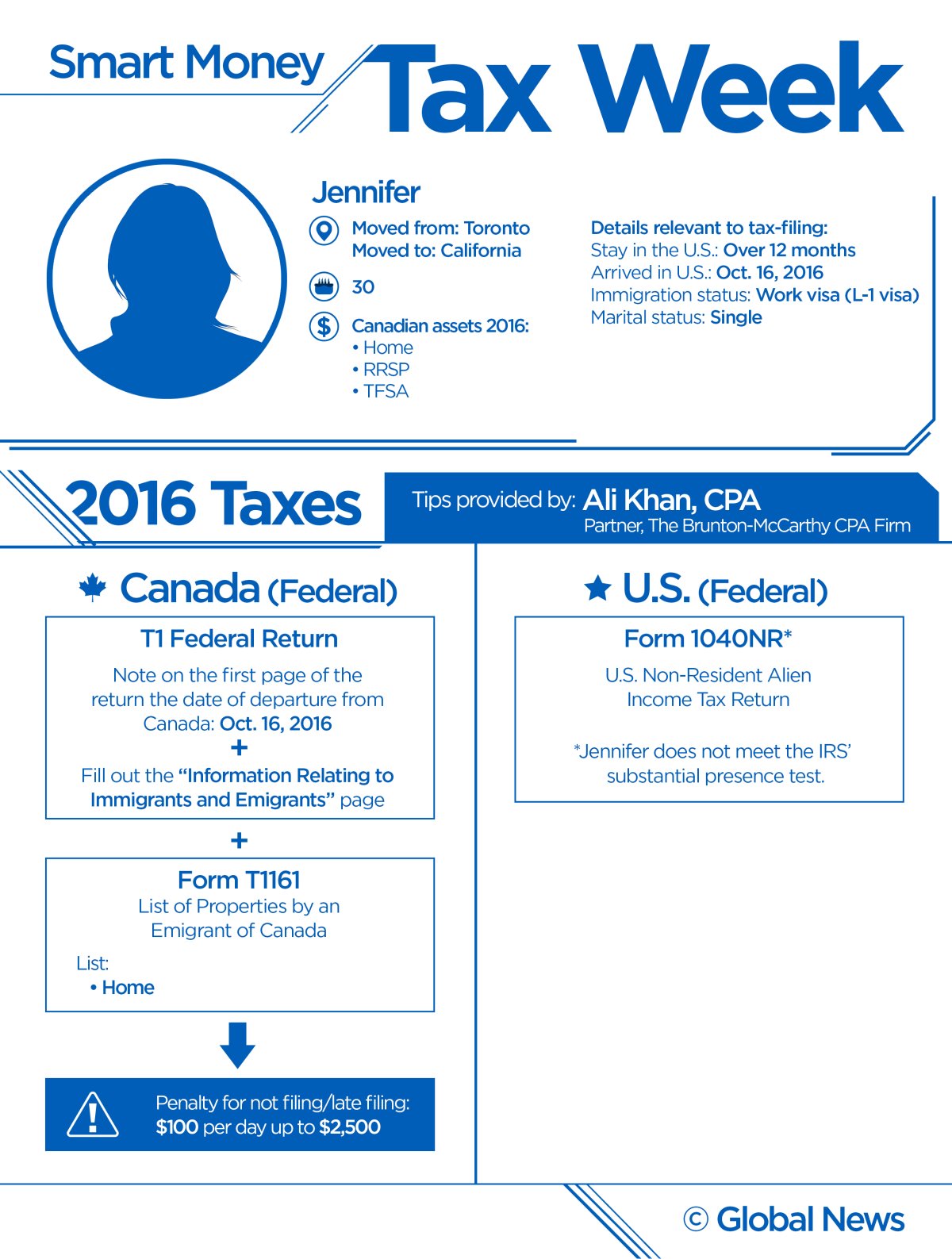

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

Renouncing Us Citizenship Expat Tax Professionals

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

What Is Expatriation Definition Tax Implications Of Expatriation

What Are The Us Exit Tax Requirements New 2022

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly